Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

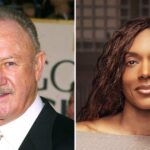

Julius Baer has named former HSBC chief executive Noel Quinn as its next chair, as the Swiss bank and wealth manager embarks on a cost-cutting drive and aims to recover from a crisis triggered by its exposure to failed property group Signa.

Quinn spent almost four decades at HSBC and was appointed group chief executive in March 2020.

He unexpectedly announced his retirement in April citing the gruelling workload and the need for a better work-life balance. Quinn said he would “pursue a portfolio career” after his exit.

Julius Baer announced last month that its outgoing chair, Romeo Lacher, would not seek re-election after serving a five-year term. The wealth manager said at the time that Lacher had informed the board of his intention to resign last year.

Quinn, who led an overhaul of Europe’s largest bank before handing over the reins in September, would be “invaluable” for the Zurich-based private bank as it enters “a new phase of . . . growth and development”, said Julius Baer’s vice-chair, Richard Campbell-Breeden.

During his five years at the helm of HSBC, Quinn helped see off an intense activist campaign from investor Ping An to split off the bank’s Asia operations and helped steer the bank through the coronavirus pandemic.

Quinn also saw the benefits of a steep rise in interest rates, which significantly boosted HSBC’s net interest income, but former colleagues have argued he did not go far enough on cost-cutting, a crucial objective for his successor, Georges Elhedery.

Quinn’s appointment is subject to shareholder approval at the bank’s annual general meeting in April. News of the nomination was first reported by Bloomberg News.

The veteran banker’s appointment follows a series of management changes at Julius Baer in the aftermath of Signa’s implosion in late 2023.

The collapse of former billionaire René Benko’s property empire — which once included stakes in Selfridges of London, New York’s Chrysler Building and the upmarket KaDeWe department store in Berlin — led to the bank writing off its SFr606mn ($700mn) exposure to the crisis-hit property company and drove a 52 per cent fall in annual profits for that year.

Former chief executive Philipp Rickenbacher left in February 2024 after five years in the job, and the wealth manager subsequently turned to Goldman Sachs banker Stefan Bollinger as its new chief executive.

Rickenbacher had originally been brought in to bring stability to the wealth manager, after regulatory probes into its dealings with Fifa, the governing body of world football, and a separate alleged corruption case.

But Julius Baer’s expansion into private debt during Rickenbacher’s tenure in charge, with a unit that lent money to unlisted companies, ended in the Signa debacle and his exit.

Bollinger, who only started last month, has launched an aggressive cost-cutting strategy, including slashing jobs, slimming down the executive board and refining the Swiss group’s strategy.