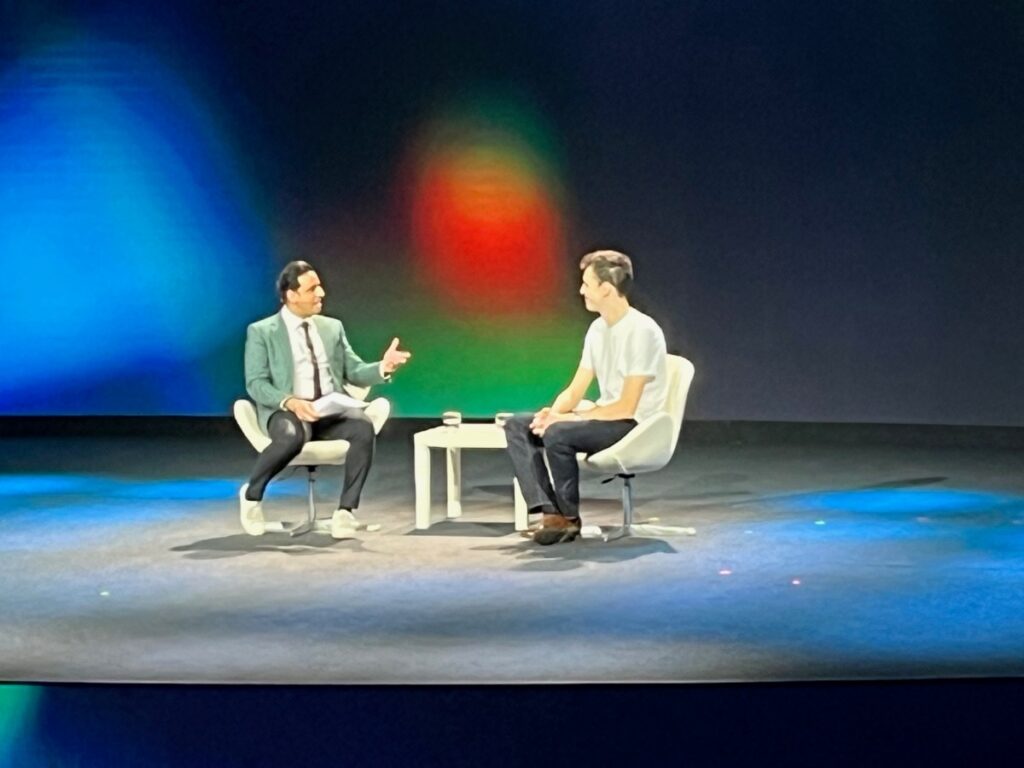

Mistral CEO Arthur Mensch brought a sales pitch to Mobile World Congress on Tuesday, urging delegates at the world’s biggest telecoms confab in Barcelona to invest in building data center infrastructure and “becoming hyperscalers” to boost the regional AI ecosystem.

“We would welcome more domestic effort in making more data centers,” he said during an on-stage Q&A in response to a question about whether Europe is directing enough investment at AI.

The foundational model maker is investing in building its own data center in France, and Mensch noted that it’s “moving slightly down the stack so we can serve data centers.”

“For me, the AI revolution is also bringing opportunities to decentralize the cloud,” he also said, advocating for “more actors in the field” compared to the current cloud market that’s dominated by a trio of hyperscaler giants: Amazon, Google and Microsoft.

Mensch also called for European players to reduce their reliance on U.S. tech, by buying homegrown where possible — while emphasizing the need to be “pragmatic” since he said there are no non-U.S. alternatives to some key tech infrastructure.

Asked whether European lawmakers should be taking inspiration from the Trump administration when it comes to slashing regulation, Mensch dodged the opportunity to make a full frontal attack on rules like the bloc’s AI Act. Instead, he suggested that the bigger headache for businesses is dealing with fragmentation across the 27 Member States of the EU’s single market.

“We’re not too concerned about the regulation as a startup,” he said. “The one thing that, I guess, is a difficulty in Europe is the fragmentation of the market.”

Mensch went on to voice support for consolidation in the telecoms space. “Consolidation of larger tech players could be an asset,” he suggested to industry delegates — saying fewer telcos per EU market would reduce the number of discussions it needs to have to ink partnerships with telcos.

What business is the AI startup jockeying to get from the telecoms sector? Mensch said AI is going to have lots of implications for network operators as infrastructure will need to change to accommodate the increasingly “personalized” streams of data that AI will enable — ergo, working with telcos on network upgrades is in the frame.

He also suggested there are opportunities for making “distribution partnerships” with the industry on the AI consumer product side in order “to make sure that everyone has access to strong AI systems.”

In France, Mistral has already signed a distribution agreement with Free for Le Chat, its AI assistant. Free subscribers can access Le Chat Pro at no cost for one year, after which they will pay the regular monthly subscription fee. It is worth noting that Free is owned by Iliad, a telecom company controlled by French billionaire Xavier Niel, who is also an investor in Mistral.

Additionally, AI could help telcos reduce their operating expenses, Mensch said.

“But on the AI regulation front we’re in a workable state — it’s not ideal,” he added regarding the red tape issue. He also welcomed a “change of perspective” among EU policymakers concerning the need to invest in AI.

“I think the EU AI Act came a little too early, and it’s too focused on the technology side — and so we have difficulty in finding technological ways to implement it. So we’re working with the regulators to make sure that this is resolved,” he added.

Responding to a final question asking about the next tech developments coming down the pipe, Mensch predicted that AI models will become increasingly “specialized.”

Over the next couple of years, Mistral will focus on capturing data from every interaction between models and humans. This expertise will be used to develop better models — “to make specialized AI system that will be your own,” as he put it.