GTC, Nvidia’s biggest conference of the year, begins Monday and runs till Friday in San Jose. TechCrunch will be on the ground covering the news as it happens — and we’re expecting a healthy dose of announcements.

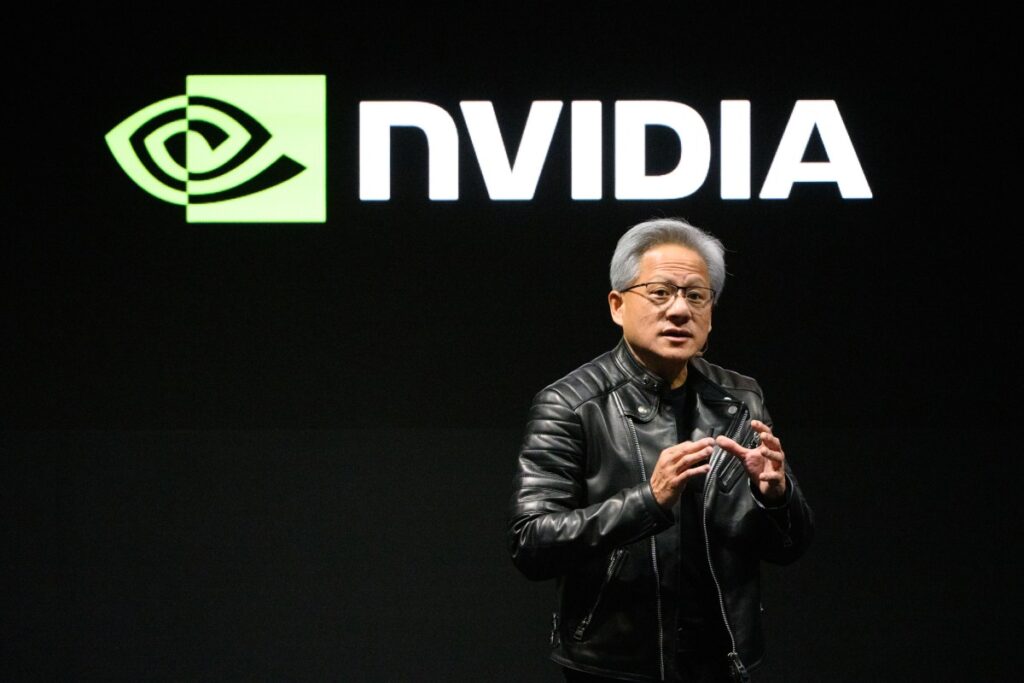

CEO Jensen Huang will give a keynote address at the SAP Center on Tuesday at 10 a.m. Pacific, focusing on — what else? — AI and accelerating computing technologies, according to Nvidia. The company is also teasing reveals related to robotics, sovereign AI, AI agents, and automotive — plus 1,000 sessions with 2,000 speakers and close to 400 exhibitors.

Here’s how to watch the Nvidia GTC 2025 keynote online, along with many other sessions, talks, and panels.

So what do we expect to see at GTC? Well, Nvidia typically reserves a big chunk of the conference for GPU-related debuts. A new, upgraded iteration of the company’s Blackwell chip lineup seems likely.

During Nvidia’s most recent earnings call, Huang confirmed that the upcoming Blackwell B300 series, codenamed Blackwell Ultra, is slated for release in the second half of this year. In addition to higher computing performance, Blackwell Ultra cards pack more memory (288GB), an attractive feature for customers looking to run and train memory-hungry AI models.

Rubin, Nvidia’s next-gen GPU series, is almost certain to get a mention at GTC alongside Blackwell Ultra. Due out in 2026, Rubin promises to deliver what Huang has described as a “big, big, huge step up” in computing power.

Huang said during the aforementioned Nvidia earnings call that he’d talk about post-Rubin products at GTC, as well. That could be Rubin Ultra GPUs, or perhaps the GPU architecture that’ll come after the Rubin family.

Beyond GPUs, Nvidia may illuminate its approach to recent quantum computing advancements. The company has scheduled a “quantum day” for GTC, during which it’ll host execs from prominent companies in the space to “[map] the path toward useful quantum applications.”

One thing’s for sure: Nvidia could use a win.

Early Blackwell cards reportedly suffered from severe overheating issues, causing customers to cut their orders. U.S. export controls and fears of tariffs have massively depressed Nvidia’s stock price in recent months. At the same time, the success of Chinese AI lab DeepSeek, which developed efficient models competitive with models from leading AI labs, has prompted investors to worry about the demand for powerful GPUs like Blackwell.

Huang has asserted that DeepSeek’s rise to prominence will in fact be a net positive for Nvidia because it’ll accelerate the broader adoption of AI technology. He has also pointed to the growth of power-hungry so-called “reasoning” models like OpenAI’s o1 as Nvidia’s next mountain to climb.

To be clear, Nvidia isn’t exactly hurting. The company reported a record-breaking quarter in February, notching $39.3 billion in revenue and projecting $43 billion in revenue for the subsequent quarter. While rivals such as AMD have begun to encroach on the company’s territory, Nvidia still commands an estimated 82% of the GPU market.