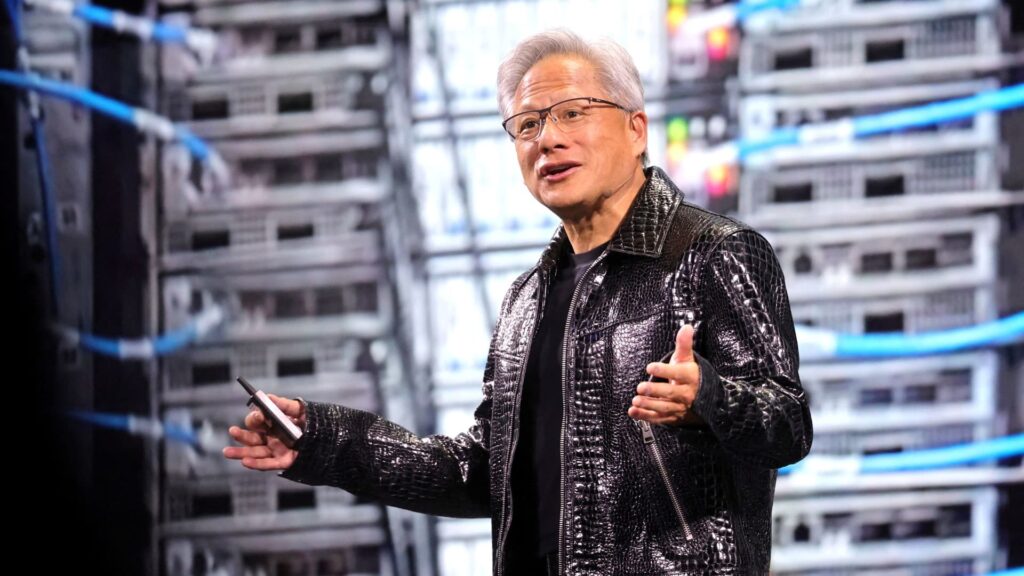

Nvidia CEO Jensen Huang gives a keynote address at CES 2025, an annual consumer electronics trade show, in Las Vegas, Nevada, U.S. Jan. 6, 2025.

Steve Marcus | Reuters

Alarm bells went off in 2024 when Singapore unexpectedly emerged as Nvidia’s second-largest revenue source. The disclosure fueled widespread speculation that Nvidia’s artificial intelligence chips were being channeled to China.

Those concerns intensified in January after China’s DeepSeek burst onto the international AI scene due to the sophistication and reported cost-effectiveness of its model. DeepSeek’s AI is trained on Nvidia’s graphics processing units despite export restrictions designed to keep the technology out of China.

Singapore has been working to dismantle a shadow network trafficking Nvidia’s cutting-edge AI chips, and late last week, authorities there detained three people on charges of deliberately misrepresenting the final destination of U.S.-manufactured servers, likely containing Nvidia’s highly sought-after chips.

Singapore’s Home Affairs and Law Minister K Shanmugam revealed Monday that servers from Dell and Super Micro Computer were shipped to Malaysia, raising the critical question: Was Malaysia truly the final destination?

Nvidia declined to provide comment on any of these developments.

Nvidia shares tumbled almost 8% on Monday and are now down 14% in 2025, a slide that’s pushed the company’s market cap below $3 trillion. Super Micro shares fell 11% on Monday, and Dell’s stock was down about 6%.

While Singapore has firmly rejected allegations of serving as a conduit to China, Nvidia highlighted a crucial distinction in what it means to be a customer in its annual report filed last week.

Singapore accounted for 18% of Nvidia’s total revenue, approximately $24 billion, in the fiscal year ended Jan. 28, based on “customer billing location,” but less than 2% of revenue, about $473 million, in terms of products shipped to the country.

“Customers use Singapore to centralize invoicing while our products are almost always shipped elsewhere,” Nvidia said in its annual report.

The arrests in Singapore demonstrate that a sophisticated network of resellers continues to operate despite increasing scrutiny.

Analysts at Mizuho warn that any comprehensive ban on Nvidia chip exports to China could eliminate $4 billion to $5 billion from Nvidia’s projected revenue for this fiscal year. The company said on its fourth-quarter earnings call that data center sales in China as a percentage of total data center revenue “remained well below levels seen on the onset of export controls.”

As digital borders harden between East and West, silicon smugglers may find new routes. But the race for AI dominance ensures this high-stakes game will continue, with implications far beyond corporate earnings.