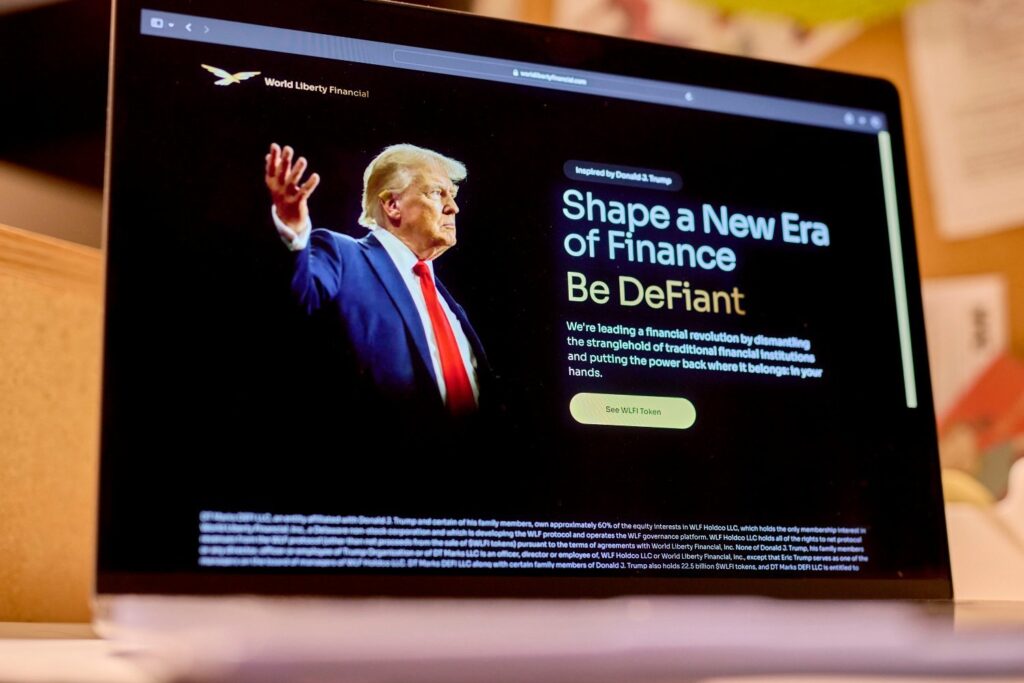

World Liberty Financial, the decentralized finance protocol that was founded and run primarily by President Donald Trump’s sons, announced Tuesday that it will launch a stablecoin called USD1. That announcement comes less than one week after President Trump threw his support behind a new legal framework that would seek to normalize stablecoins.

According to Reuters, USD1 will be backed by U.S. Treasury bonds, dollars, and other cash equivalents. It’ll launch on Ethereum and Binance Smart Chain blockchains, with plans to expand to other protocols in the future.

Like most stablecoins, USD1 seeks to maintain a fixed value of $1 rather than be a more volatile token. Stablecoins are typically meant for crypto bros to park their cash in. Think of stablecoins like poker chips—you buy in with real cash, use the chips to play the games (in this case, throwing money into some memecoin or whatever), and then cash them out for real money again when you’re done.

But World Liberty Financial certainly seems to have a particular audience in mind with USD1. Zach Witkoff, one of the founders of the company alongside the Trumps, said the company is “offering a digital dollar stablecoin that sovereign investors and major institutions can confidently integrate into their strategies for seamless, secure cross-border transactions.” So it sounds like they’re quite interested in overseas money.

That might raise a red flag, you know, with Trump being the president of the United States and whatnot. World Liberty Financial has already been accused of basically being a favor-trading fund—for instance, the Securities and Exchange Commission paused a fraud case against Chinese national Justin Sun after he purchased millions of World Liberty Financial’s token. It seems the company is inviting other overseas interests to trust it to hold onto their money with this stablecoin project. (It’s also worth noting that Zach Witkoff’s dad, Steve Witkoff, is currently serving as the Trump administration’s Special Envoy to the Middle East.)

That is far from the only red flag flying full mast with this announcement, though. Just last week, Trump spoke at the Digital Asset Summit 2025, and called on Congress to “pass landmark legislation creating simple, common-sense rules for stablecoins and market structure”—a reference to a the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act that just got approval from the Senate Banking Committee earlier this month. That bill would establish a regulatory framework for stablecoins that would effectively normalize their usage in our broader financial system.

A couple things to know about the GENIUS Act: First, the Senators who introduced it want stablecoins to “strengthen the dollar’s supremacy” and drive “demand for U.S. Treasuries” by making sure stablecoins are pegged to the dollar. Wouldn’t you know it, USD1 does exactly that. Second, critics of the bill, including Senator Elizabeth Warren, have pointed out that it doesn’t offer sufficient national security protections and could allow money to funnel into stablecoins from foreign countries. World Liberty Financial is positioning its stablecoin as an option for foreign investors. Are those statements related? Who can say for sure.

Lots of money can pass through stablecoins, and it generates big bucks for its operators. Tether reported that it racked up $13 billion in profits in 2024 alone, primarily through transaction fees and interest on its treasury holdings. This, despite the fact that most stablecoins have, at some point, become unpegged from their promised value, potentially causing instability and an inability for investors to get their money out.

Seems like a promising business for the guys at World Liberty Financial, who somehow continue to be ahead of the curve on what the Trump administration plans to do with crypto regulations. Guess it’s nice to have a direct line to the guy signing the laws.